Demo - Fairness Analysis of FICO¶

Adapted version of:

Fairness and machine learning book - Chapter 2 and code repository.

Hardt, M., Price, E., & Srebro, N. (2016). Equality of opportunity in supervised learning. In Advances in neural information processing systems (pp. 3315-3323).

Attacking discrimination with smarter machine learning by Google

The analysis is based on data from Report to the Congress on Credit Scoring and Its Effects on the Availability and Affordability of Credit by the Federal Reserve. The data set provides aggregate statistics from 2003 about a credit score, demographic information (race or ethnicity, gender, marital status), and outcomes (to be defined shortly).

In the USA there are three majour creding agencies, which are for-profit organizations. They offer risk score based on the data they collected. Wre are going to look into FICO score of TransUnion (called TransRisk). The TransRisk score is in turn based on a proprietary model created by FICO, hence often referred to as FICO scores.

Source: Wikipedia

Source: Wikipedia

From Fairness and Machine Learning - Limitations and Opportunities: > Regulation of credit agencies in the United States started with the Fair Credit Reporting Act, first passed in 1970, that aims to promote the accuracy, fairness, and privacy of consumer of information collected by the reporting agencies. The Equal Credit Opportunity Act, a United States law enacted in 1974, makes it unlawful for any creditor to discriminate against any applicant the basis of race, color, religion, national origin, sex, marital status, or age.

In our analysis we’ll use on the joint statistics of score, race, and outcome.¶

import pandas as pd

import matplotlib.pylab as plt

from responsibly.fairness.metrics import plot_roc_curves

from responsibly.fairness.interventions.threshold import (find_thresholds,

plot_fpt_tpr,

plot_roc_curves_thresholds,

plot_costs,

plot_thresholds)

FICO Dataset¶

FICO dataset can be loaded directly from responsibly. The dataset,

in this case, is aggregate, i.e., there is no outcome and prediction

information per individual, but summarized statistics for each FICO

score and race/race/ethnicity group.

from responsibly.dataset import build_FICO_dataset

FICO = build_FICO_dataset()

FICO is a dictionary that holds variaty of data:

FICO.keys()

dict_keys(['rocs', 'proportions', 'total', 'base_rate', 'tpr', 'performance', 'pdf', 'aucs', 'totals', 'cdf', 'base_rates', 'fpr'])

help(build_FICO_dataset)

Help on function build_FICO_dataset in module responsibly.dataset.fico:

build_FICO_dataset()

Build the FICO dataset.

Dataset of the credit score of TransUnion (called TransRisk).

The TransRisk score is in turn based on

a proprietary model created by FICO,

hence often referred to as FICO scores.

The data is aggregated, i.e., there is no outcome

and prediction information per individual,

but summarized statistics for each FICO score

and race/race/ethnicity group.

+---------------+------------------------------------------------------+

| FICO key | Meaning |

+===============+======================================================+

| total | Total number of individuals |

+---------------+------------------------------------------------------+

| totals | Number of individuals per group |

+---------------+------------------------------------------------------+

| cdf | Cumulative distribution function of score per group |

+---------------+------------------------------------------------------+

| pdf | Probability distribution function of score per group |

+---------------+------------------------------------------------------+

| performance | Fraction of non-defaulters per score and group |

+---------------+------------------------------------------------------+

| base_rates | Base rate of non-defaulters per group |

+---------------+------------------------------------------------------+

| base_rate | The overall base rate non-defaulters |

+---------------+------------------------------------------------------+

| proportions | Fraction of individuals per group |

+---------------+------------------------------------------------------+

| fpr | True Positive Rate by score as threshold per group |

+---------------+------------------------------------------------------+

| tpr | False Positive Rate by score as threshold per group |

+---------------+------------------------------------------------------+

| rocs | ROC per group |

+---------------+------------------------------------------------------+

| aucs | ROC AUC per group |

+---------------+------------------------------------------------------+

:return: Dictionary of various aggregated statics

of the FICO credit score.

:rtype: dict

References:

- Based on code (MIT License) by Moritz Hardt

from https://github.com/fairmlbook/fairmlbook.github.io

- https://fairmlbook.org/demographic.html#case-study-credit-scoring

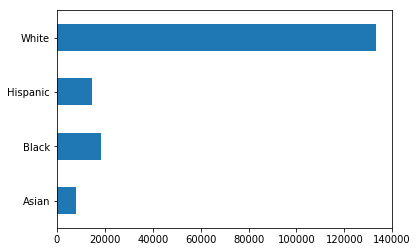

Counts by Race or Ethnicity¶

sum(FICO['totals'].values())

174047

pd.Series(FICO['totals']).plot(kind='barh');

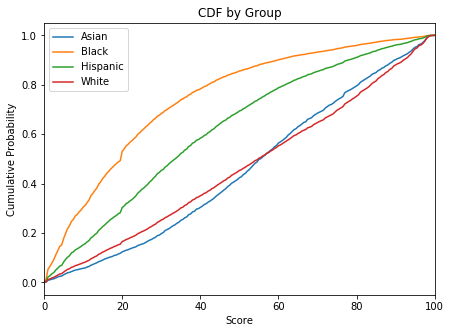

Score Distribution¶

The score used in the study is based on the TransUnion TransRisk score. TransUnion is a US credit-reporting agency. The TransRisk score is in turn based on a proprietary model created by FICO, hence often referred to as FICO scores. The Federal Reserve renormalized the scores for the study to vary from 0 to 100, with 0 being least creditworthy.

The information on race was provided by the Social Security Administration, thus relying on self-reported values.

The cumulative distribution of these credit scores strongly depends on the group as the next figure reveals.

FICO['cdf'].head()

| Asian | Black | Hispanic | White | |

|---|---|---|---|---|

| Score | ||||

| 0.0 | 0.0000 | 0.0007 | 0.0001 | 0.0001 |

| 0.5 | 0.0013 | 0.0119 | 0.0047 | 0.0026 |

| 1.0 | 0.0088 | 0.0533 | 0.0222 | 0.0116 |

| 1.5 | 0.0107 | 0.0647 | 0.0274 | 0.0143 |

| 2.0 | 0.0132 | 0.0789 | 0.0349 | 0.0180 |

FICO['cdf'].tail()

| Asian | Black | Hispanic | White | |

|---|---|---|---|---|

| Score | ||||

| 98.0 | 0.9894 | 0.9989 | 0.9966 | 0.9894 |

| 98.5 | 0.9961 | 0.9995 | 0.9988 | 0.9962 |

| 99.0 | 0.9989 | 0.9999 | 0.9998 | 0.9991 |

| 99.5 | 0.9994 | 1.0000 | 1.0000 | 0.9998 |

| 100.0 | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

f, ax = plt.subplots(1, figsize=(7, 5))

FICO['cdf'].plot(ax=ax)

plt.title('CDF by Group')

plt.ylabel('Cumulative Probability');

Outcome Variable¶

Performance variable that measures a serious delinquency in at least one credit line of a certain time period:

“(the) measure is based on the performance of new or existing accounts and measures whether individuals have been late 90 days or more on one or more of their accounts or had a public record item or a new collection agency account during the performance period.” - from the Federal Reserve report

The FICO['performance'] holds the percentage of non-defaulters for

every score value (rows) and race/ethnicity group (columns):

FICO['performance'].head()

| Asian | Black | Hispanic | White | |

|---|---|---|---|---|

| Score | ||||

| 0.0 | 0.0523 | 0.0033 | 0.0095 | 0.0146 |

| 0.5 | 0.0552 | 0.0077 | 0.0151 | 0.0205 |

| 1.0 | 0.0581 | 0.0120 | 0.0207 | 0.0264 |

| 1.5 | 0.0610 | 0.0164 | 0.0262 | 0.0323 |

| 2.0 | 0.0639 | 0.0207 | 0.0318 | 0.0382 |

FICO['performance'].tail()

| Asian | Black | Hispanic | White | |

|---|---|---|---|---|

| Score | ||||

| 98.0 | 0.9916 | 0.9818 | 0.9891 | 0.9899 |

| 98.5 | 0.9917 | 0.9840 | 0.9897 | 0.9902 |

| 99.0 | 0.9918 | 0.9861 | 0.9902 | 0.9905 |

| 99.5 | 0.9920 | 0.9882 | 0.9908 | 0.9907 |

| 100.0 | 0.9921 | 0.9904 | 0.9913 | 0.9910 |

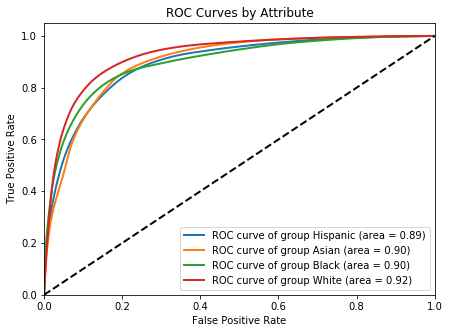

Separation Fairness Criterion¶

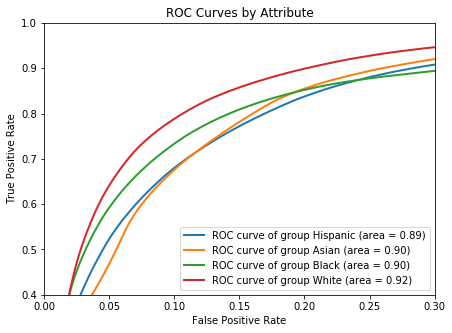

By the separation criterion of a binary classifier, the FPR and TPR should be equal across the groups.

plot_roc_curves(FICO['rocs'], FICO['aucs'],

figsize=(7, 5));

The meaning of true positive rate is the rate of predicted positive performance given positive performance. Similarly, false positive rate is the rate of predicted negative performance given a positive performance.

plot_roc_curves(FICO['rocs'], FICO['aucs'],

figsize=(7, 5));

plt.xlim(0, 0.3)

plt.ylim(0.4, 1);

Thresholds vs. FPR and TPR¶

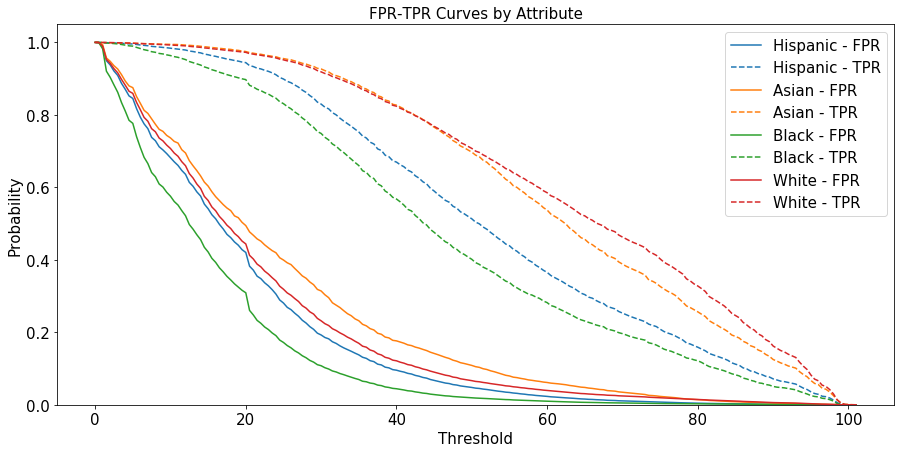

The ROC is paramaritazied over the thershold, so the same threshold might be related to different (FPR, TPR) pairs for each group. We can observe it by plotting the FPR and the TPR as a function of the threshold by the groups.

plot_fpt_tpr(FICO['rocs'], figsize=(15, 7),

title_fontsize=15, text_fontsize=15);

Therefore, a naive choice of a single threshold will cause to a violation of the separation fairness criterion, as there will be different in FPR and TPR between the groups.

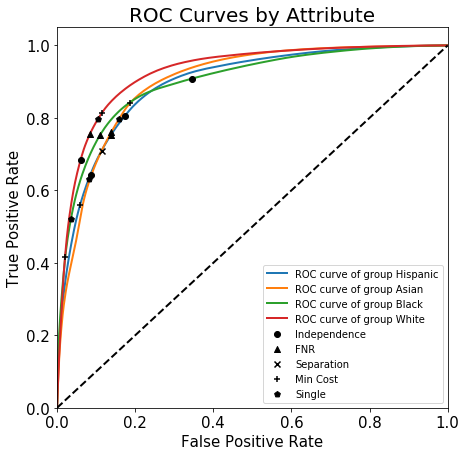

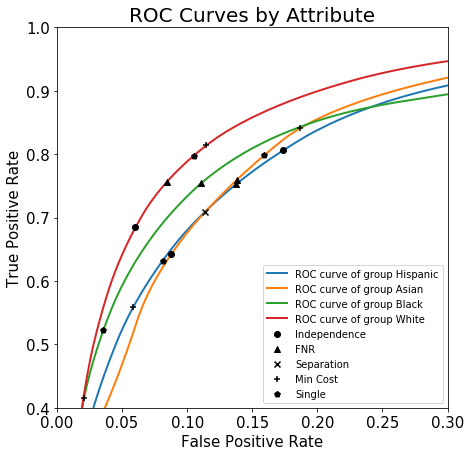

Comparison of Different Criteria¶

Single threshold (Group Unaware)

Minimum Cost

Independence (Demographic Parity)

FNR (Equality of opportunity)

Separation (Equalized odds)

Cost: \(FP = - 5 \cdot TP\)¶

COST_MATRIX = [[0, -5/6],

[0, 1/6]]

thresholds_data = find_thresholds(FICO['rocs'],

FICO['proportions'],

FICO['base_rate'],

FICO['base_rates'],

COST_MATRIX)

plot_roc_curves_thresholds(FICO['rocs'], thresholds_data,

figsize=(7, 7),

title_fontsize=20, text_fontsize=15);

plot_roc_curves_thresholds(FICO['rocs'], thresholds_data,

figsize=(7, 7),

title_fontsize=20, text_fontsize=15)

plt.xlim(0, 0.3)

plt.ylim(0.4, 1);

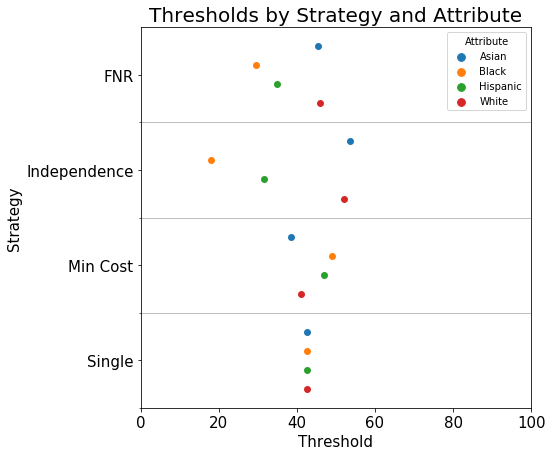

Thresholds by Strategy and Group¶

plot_thresholds(thresholds_data,

xlim=(0, 100), figsize=(7, 7),

title_fontsize=20, text_fontsize=15);

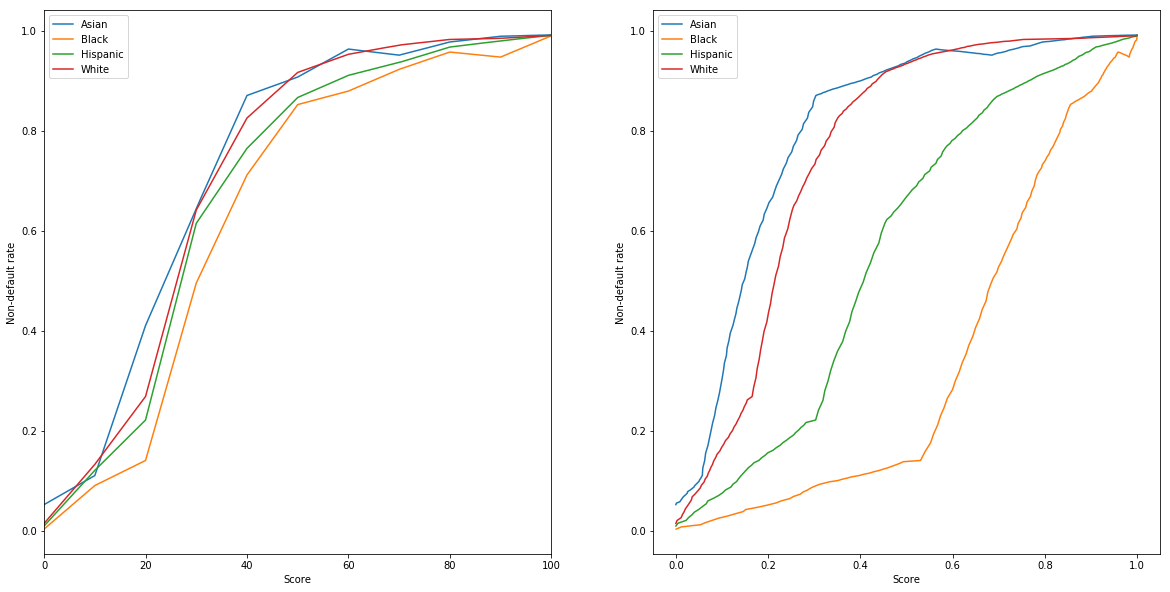

Sufficiency Fairness Criterion - Calibration¶

f, axes = plt.subplots(nrows=1, ncols=2, figsize=(20, 10))

FICO['performance'].plot(ax=axes[0])

axes[0].set_ylabel('Non-default rate')

for group in FICO['cdf'].columns:

axes[1].plot(FICO['cdf'][group], FICO['performance'][group],

label=group)

axes[1].set_ylabel('Non-default rate')

axes[1].set_xlabel('Score')

axes[1].legend();

Due to the differences in score distribution by group, it could nonetheless be the case that thresholding the score leads to a classifier with different positive predictive values in each group.